salt tax deduction calculator

Prior to the TCJA there were no restrictions on SALT deductions but beginning in 2018 taxpayers deductions were capped at 10000. Your standard deduction is a fixed amount that you can deduct that is based on your filing status.

State And Local Tax Salt Deduction Salt Deduction Taxedu

Starting with the 2018 tax year the maximum SALT deduction available was 10000.

. If you dont itemize and instead claim the standard deduction which is 12200 for 2019 and 12400 for 2020 you cant claim any of the state and local tax deductions. The SALT deduction applies to property sales or income taxes already paid to state and local governments. The Tax Cuts and Jobs Act capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both.

Keep detailed records. Answer a few questions about yourself and large purchases you made in the year of the tax return you are completing. The SALT cap reduced the TCJA tax cuts significantly for many high.

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR. For taxpayers who would have itemized deductions without access to the SALT deduction it generates tax savings equal to the amount deducted multiplied by the taxpayers marginal income tax rate. This means that in 2026 the SALT deduction once.

This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017. Before the creation of a cap on this deduction 91 of the benefit of the SALT deduction. The SALT deduction can only be claimed if you itemize on your tax return - that is when your itemized deductions are greater than your standard deduction and you file or e-File a Schedule A.

The most commonly used tax deduction is the standard deduction which is a deduction method that all tax filers qualify for and can choose to use if they want to. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to 1 million. For example a taxpayer with 20000 of eligible state and local taxes and a top marginal tax rate of 35 would save 7000 from the SALT deduction.

The partnership gets a deduction of 26000 which exceeds the previous 10000 SALT limitation imposed at the individual 1040 return level. Sales Tax Deduction Calculator. Like other individual tax provisions in the TCJA it expires at the end of 2025.

This deduction is available to taxpayers who itemize their. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. New limits for SALT tax write off.

The Tax Cuts and Jobs Act TCJA of 2017 imposed a 10000 cap on state and local tax deductions under the federal income tax. Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately. Jane and John claim the PTE payment on their individual returns similar to withholding with any excess payment resulting in a.

Income taxes or sales taxes. For example if the higher SALT deduction reduces taxable income by 10000 and the marginal tax rate is 22 there will be 2200 in savings he said. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married. The Maryland total deduction starts with the 10000 allowed on the federal return. If the Tax Cut and Jobs Act expires in 2025 as planned the SALT deduction limits may change.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. One such provision is the 10000 cap on the state and local tax SALT deduction. Using Schedule A is commonly referred to as itemizing deductions.

For 2021 the standard deduction is 12550 for individuals and 25100 for married couples filing jointly. The benefits of the SALT deduction overwhelmingly go to high-income taxpayers particularly those in high-income and high-tax. 53 rows The House of Representatives passed a bill last week that would make permanent the individual provisions of the Tax Cuts and Jobs Act TCJA.

Estimate your state and local sales tax deduction. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

In 2022 the amounts are 12950 for individuals and 25900 for married. The SALT deduction is a federal tax deduction that you can take for money you pay in state income and property taxes. All fields marked with an asterisk are required.

The Supporting Americans with Lower Taxes SALT Act sponsored by US. If the state income tax withheld is 7600 and the property tax paid is 3800 for a total of 11400 paid the deduction for state and local taxes SALT for federal taxes is 10000. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

If you plan on claiming the SALT deduction youll need to keep detailed records of checks bank statements W2s and any other forms proving you paid state and local taxes this year. 3800 of this is treated as the full amount of the real estate tax. The state and local tax deduction is claimed on lines 5-7 on Schedule A when you file your Form 1040.

The federal tax reform law passed on Dec. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Fortunately this limitation is only temporary.

Though there is a controversy behind this change as the average SALT tax paid isnt even one-tenth. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. 52 rows The SALT deduction is only available if you itemize your deductions.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

Itemized Donation Form Template Printable Donation Form Printable Worksheets Donation Tax Deduction

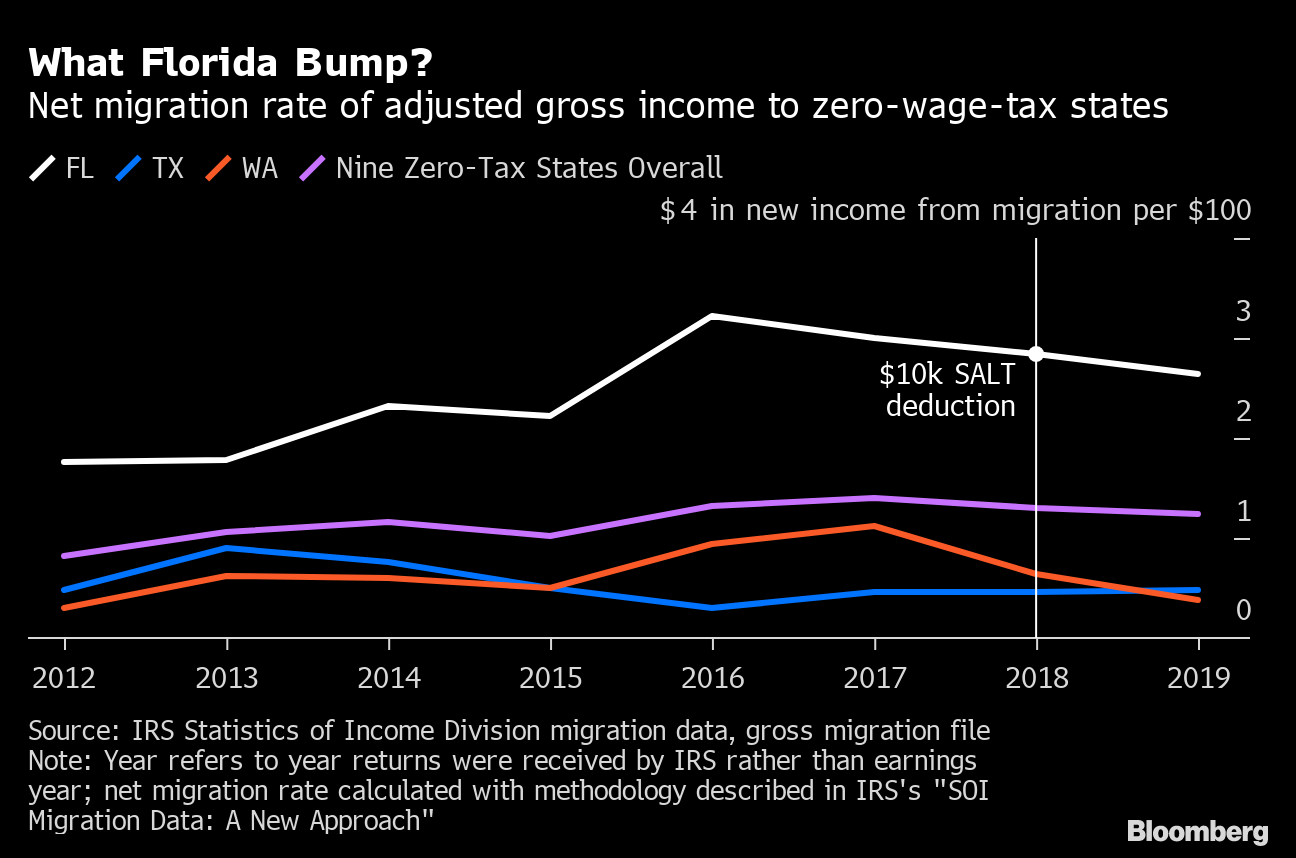

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Workaround Filing Taxes Throw In The Towel Salt

The 6 Types Of Itemized Deductions That Can Still Be Claimed After Tcja Https Www Kitces Com Blog Itemized Deducti Deduction Inherited Ira Standard Deduction

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

The Delivery Driver S Tax Information Series The Information Contained In This Information Series Is For Educa In 2021 Mileage Tracking App Doordash Mileage Deduction

What Is Salt Tax Deduction Mansion Global

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Tax Deduction 11 Million Taxpayers Taking A Hit From New Tax Law Deduction Tax Deductions Tax Refund

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)